Our Impact

$0M

Funds Loaned

$0B

Economic Impact

0

Homeowners created

Our Value

Homeownership is an incredibly important part of people’s lives. We champion racial and economic equity as a tool to uplift communities. We’re working to create thriving, mixed-income neighborhoods of choice and prosperous communities residents are proud to call home.

Education

Buying a home can be exciting, but there’s also lots to consider. Our experienced instructors offer a variety of workshops and financial consulting to support you throughout the entire process.

Home Mortgage Loans

Neighborhood Lending Services, Inc. (NLS) works with you to identify the right mortgage product and determine if you’re eligible for down payment assistance.

Grants

We offer grants that can help you buy your first home, make crucial home repairs, or save your home during hard times.

Real Estate Opportunities

We can help you identify available properties and other opportunities, making you a stakeholder and active participant in neighborhood revitalization.

People + Homes = Community

We have taken on the challenge of creating affordable housing solutions for the future while establishing healthy, mixed-income neighborhoods of choice. We work with residents and stakeholders in these communities to maintain their rich cultural legacies.

Our Approach

We’re focused on breaking down barriers to homeownership and providing access to wealth-building opportunities and resources that are available.

Give Today!

Your generous support enables us to continue to make tremendous strides in advocating for working families while strengthening and stabilizing neighborhoods.

NHS News

NeighborWorks Day Volunteer Opportunities

Calling all volunteers! Homeownership Month is back this June, which means we are celebrating by strengthening the communities we serve and live in. This June, we are hosting six NeighborWorks […]

Solving The Great Community Development Conundrum (Crain’s Chicago)

By: Donna Clarke Persistent disinvestment in people and their respective communities has contributed to an affordable housing crisis and what feels like an insurmountable sea of despair and disrepair in […]

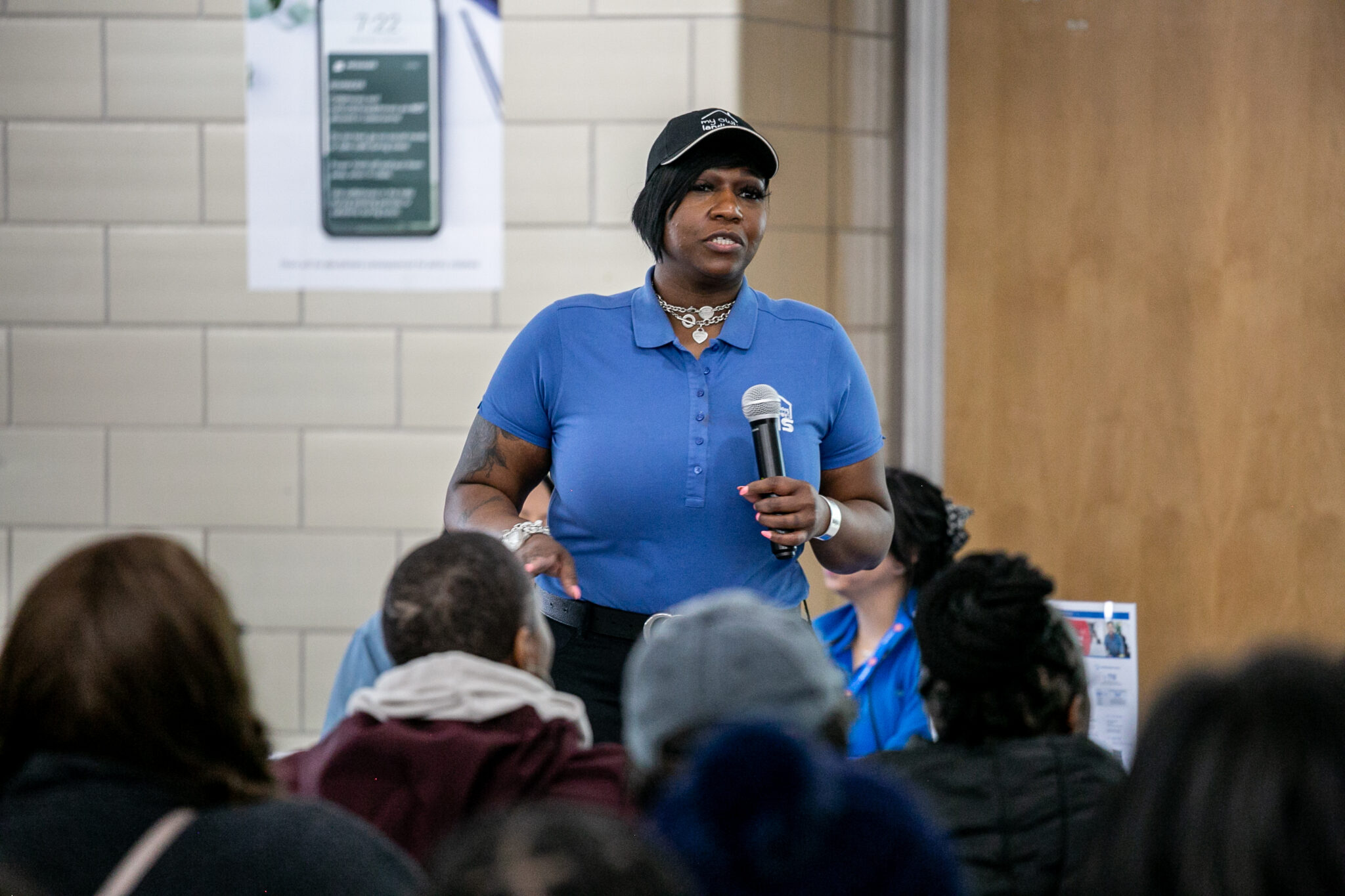

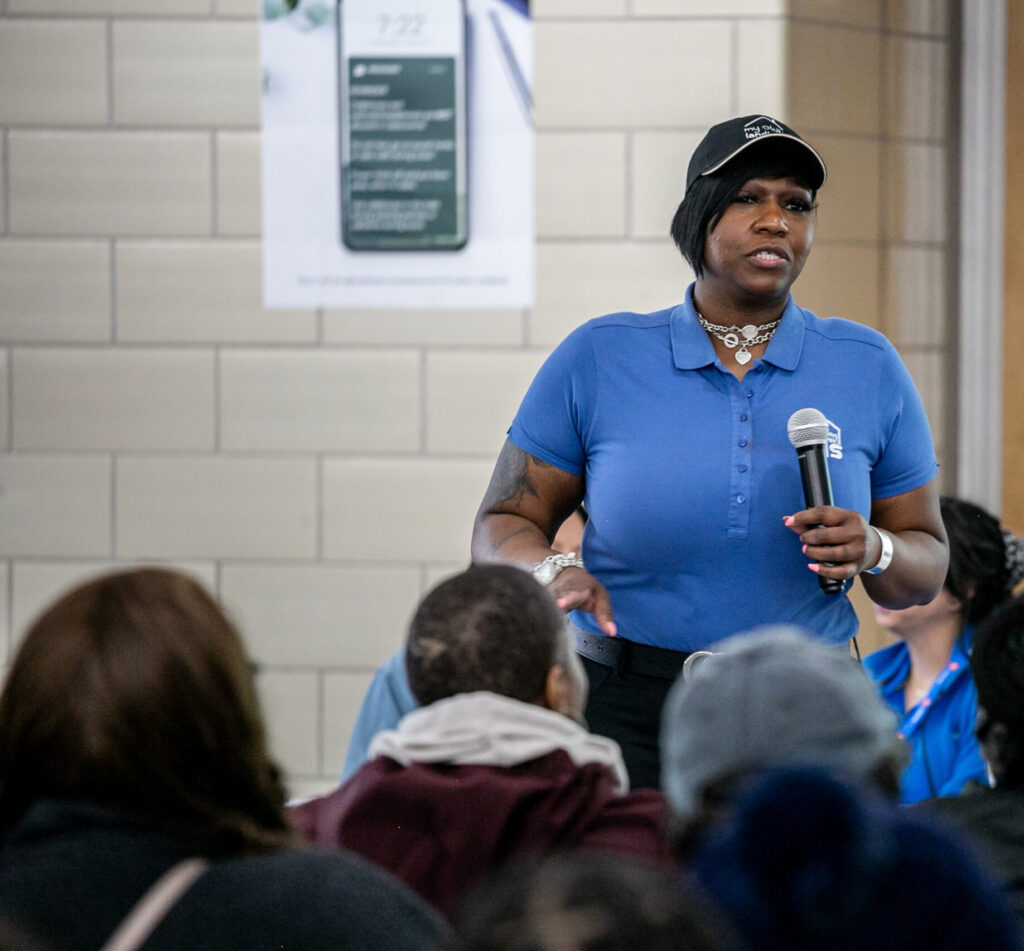

West Side Housing Fair

Ready to take the next step in your homeownership journey? There’s no better place to start than our upcoming West Side Housing Fair! [Register for free here] On […]